Everything You Need to know About Buying in the New Financial Year

Enter the new financial year understanding the lay of the land.

Buying a home is challenging even in the best circumstances. Add sky high property prices, rising mortgage rates and a serious dose of FOMO. It’s no wonder many would-be buyers are giving up on their dream of owning a home.But, following a period of unprecedented annual growth, the property market is finally showing signs of cooling, particularly in Australia’s largest cities of Sydney and Melbourne. This is largely the result of the RBA’s policy shift and tightening of interest rates to curb surging inflation. Here are some key tips for navigating our housing market in the new financial year.

Property Market Finally Slowing Down

The RBA has started a rapid tightening cycle, with the cost of living up 5.1 per cent over the past year. Banks and lenders are already passing on the rate rise to consumers, with economists predicting a number of interest rate rises before the end of the year. Westpac predicted that the cash rate could hit 2.25 per cent by May 2023, and hold through 2024, which will see a correction in dwelling prices. “We see them falling 2 per cent over 2022, a further 8 per cent in 2023, and 1 per cent in 2024,” Westpac senior economist Matthew Hassan said. Greater interest rates mean the proportion of income needed to meet repayments is also expected to hit its highest levels since 2007/08. Overall buyers are being more cautious, which coupled with affordability issues, will likely slow property growth in Sydney and Melbourne.

Changes to Home Loan Lending

With interest rates on the rise, banks are cracking down on high-risk home lending and are tightening their home loan rules. Banks are lowering their debt-to-income (DTI) limit, reducing the maximum amount buyers are allowed to borrow. ANZ announced it would reduce its cap to 7.5 times the borrowers’ annual income, while NAB have lowered its ratio limit from nine to eight. This ultimately will affect first home buyers’ borrowing power, with the cost of living and everyday expenses also soaring. Both banks and buyers need to ask whether mortgage repayments can be met if interest rates rise? Remember to factor a buffer into your budget. That being said, plunging auction rates (particularly in Sydney and Melbourne) coupled with a glut of new properties hitting the market, is giving potential buyers a lot more choice.

Location, Location, Location

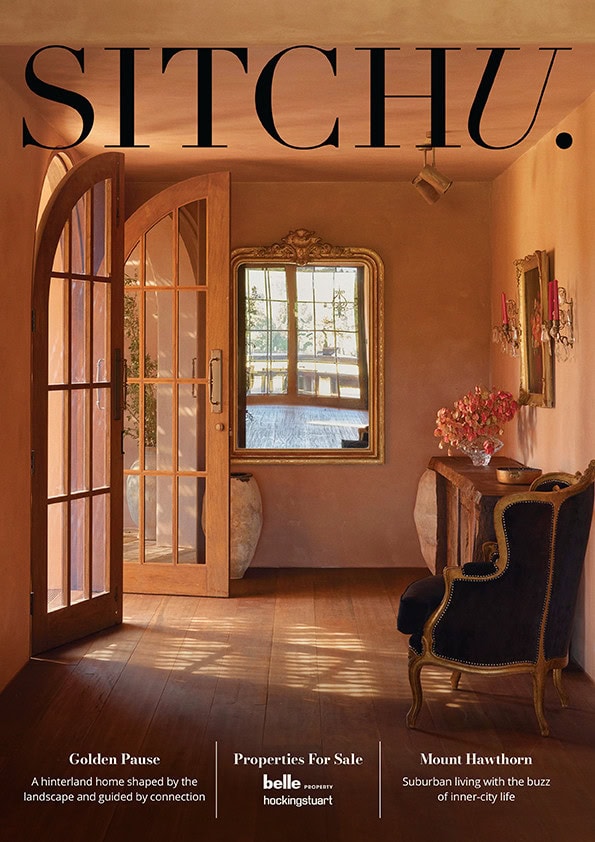

The trend for lifestyle properties will continue through 2022, with buyers paying a premium for sought-after locations. Neighbourhoods have become more important than ever, with people looking for everyday amenity – shopping, parks, sporting facilities, education and a strong sense of community – within close proximity of the city and access to good jobs. For those looking to get their foot on the ladder, family-friendly properties in inner-city suburbs are predicted to perform well. On the other hand, off the plan properties and apartments in high-rise towers are expected to underperform. Be flexible in your home search, particularly if you are priced out of a particular market. The more flexible you are in your search, the better chance you have of success.

What Help is Available for First Home Buyers?

A range of government support is available to first home buyers for the remainder of 2022. The nation-wide First Home Owner Grant (FHOG) is a one-off grant payable to first home owners. It is funded by the states and territories, and each have their own specific eligibility criteria, which you can find on the website. The Federal Government’s New Home Guarantee scheme is also set to be extended through 2023, which will support Australians looking to purchase a home with less than 20 per cent deposit. Successful applicants will be able to secure a home with just five percent deposit, with the government guaranteeing up to 15% of the home’s value. Finally, the First Home Super Saver Scheme allows you to save toward your home deposit using your super, while reducing your taxable income. The government recently announced the cap you can withdraw to put towards your deposit will be lifted from July 1, 2022 to $50,000.

Subscribe

Subscribe

Subscribe

Subscribe