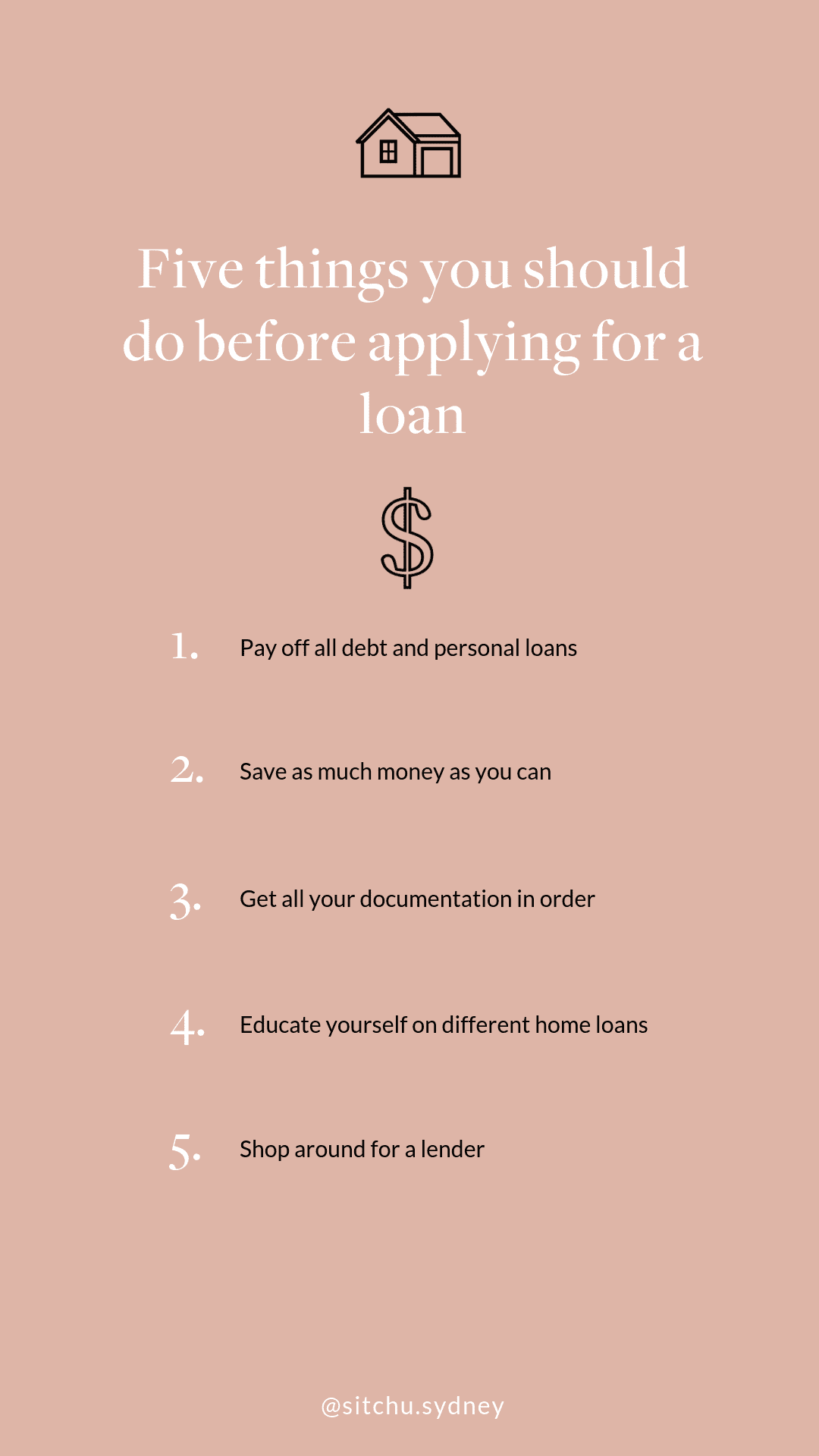

Whether you’re a first-timehome buyer or a seasoned investor, securing the right home loan is one of themost important things to factor in when you’re buying a house. And what’s more,it takes time and patience.

There’s a lot to get yourhead around; the different products that are available, the jargon, thepaperwork, not to mention the application process. It can be overwhelming tosay the least. So, to help you navigate your way through the (slightly painful)process, here’s everything you need to know about applying for a home loan – andmaking sure it’s a complete success.

1. Save up for your deposit

The first step, and often the most time consuming, is saving forthat all-important deposit. Ideally, you want to have up at least 20 per centof the property’s value saved, but you can have as little as 5 per cent.

If your deposit is less than 20 per cent you will have to payLenders Mortgage Insurance (LMI), which is a condition of home loan borrowingthat helps protect lenders against you failing to make a home loan repayment.This can be a one-off payment, or you can roll it into your monthly mortgagerepayments.

The amount you pay in LMI is dependent on how much your depositis. For example. If you have a 5 per cent deposit, you will pay more for LMIthan someone who has a 15 per cent deposit.

2. Prove you are in a stable job

Whether you’re a permanent employee or self-employed, lendersneed to know that you can service a loan. Being employed at the same companyfor at least six months gives the lender some level of assurance. If you’re acontractor or self-employed, you need a minimum of one to two years of beingself-employed to show that you’re able to service the loan.

To prove your employment status and income, you need to providedocumentation. For employees, you need your last two payslips, contractors andthe self-employed need tax statements for the past two years. If you havemultiple sources of income, you will need to provide documentation for eachsource. Some lenders may also require a letter of employment to support yourdocumentation.

3. Clear your debts and get your finances in order

Lenders will be looking into your finances and lifestyle to makesure that you live within your means. Any outstanding debt that you have willwork against your borrowing capacity. Lenders will assess your debt to incomeratio, so if you have any personal loans, credit cards, car finance or studentdebt, pay it off before you speak to lenders. Also, avoid taking out any personalloans or spending on your credit card while you’re in the process of applyingfor a home loan.

Aside from the initial deposit, you will also need to make sureyou have enough money to cover the fees that pop up during the process,including stamp duty. Crunch the numbers, look at how much you are willing toborrow (not how much you can borrow) as you don’t want to overstretch yourself,putting a strain on your day-to-day lifestyle.

4. Do your research

There are a variety of home loans to choose from and selectingthe right one for you is a critical part of the process. It’s important toeducate yourself on the different types of home loans, their overall productfeatures and the interest rates. It’s a competitive market, so shopping aroundand negotiating with your lender will pay off.

To start you off, here is a basic overview:

Fixed Rate Home Loan

With a fixed rate home loan your repayments will be charged at the same interest rate for one to five years, depending on the agreed terms. The benefit of this type of loan is that you know exactly what your repayments will be, helping you stay in control of your budget.

Variable Rate Home Loan

A variable home loan starts with a low-interest rate, and after a fixed term begins to fluctuate with the market as set by the Reserve Bank, therefore repayments can vary. What makes this type of home loan so appealing is that you can package other products (credit or debit cards) with this type of home loan.

Home loans with redraw facilities

Getting a home loan with redraw facilities provides you with the flexibility to repay more than your minimum repayment amount and if needed, withdraw from it at a later date. The balance you would be able to draw from is the extra payments you have made on top of your required monthly repayments. There are a lot of financial and tax benefits to this, so talk to your lender about whether this is a good option for you.

5. Getting approval

Once you have all your paperwork and finances in order, thelender will provide you with a home loan guarantee or pre-approval certificate,which means, subject to conditions, you have been approved for a set amount topurchase a property.

The home buying process can take longer than expected, so ifthree to six months has lapsed, visit your lender to ensure your pre-approvalstill stands. If too much time has passed, you may have to reapply.

It’s also worth noting that when you apply for a home loan, youneed to factor in your current situation, and how your circumstances may change over the coming years – willyou get married, have children, have a change in your career? Arming yourselfwith this information will help determine what loan features are best for you.

Want to know more? AustralianSecurities & Investment Commissions talks about the different types of homeloans available in more detail

Handy checklists

Subscribe

Subscribe

Subscribe

Subscribe