Your Complete First Home Buyer’s Checklist

Being prepared is the first step to purchasing your dream home.

Enter the market with confidence as you begin your property journey. Here are the key things first home buyers should know – so you can get it right the first time around.

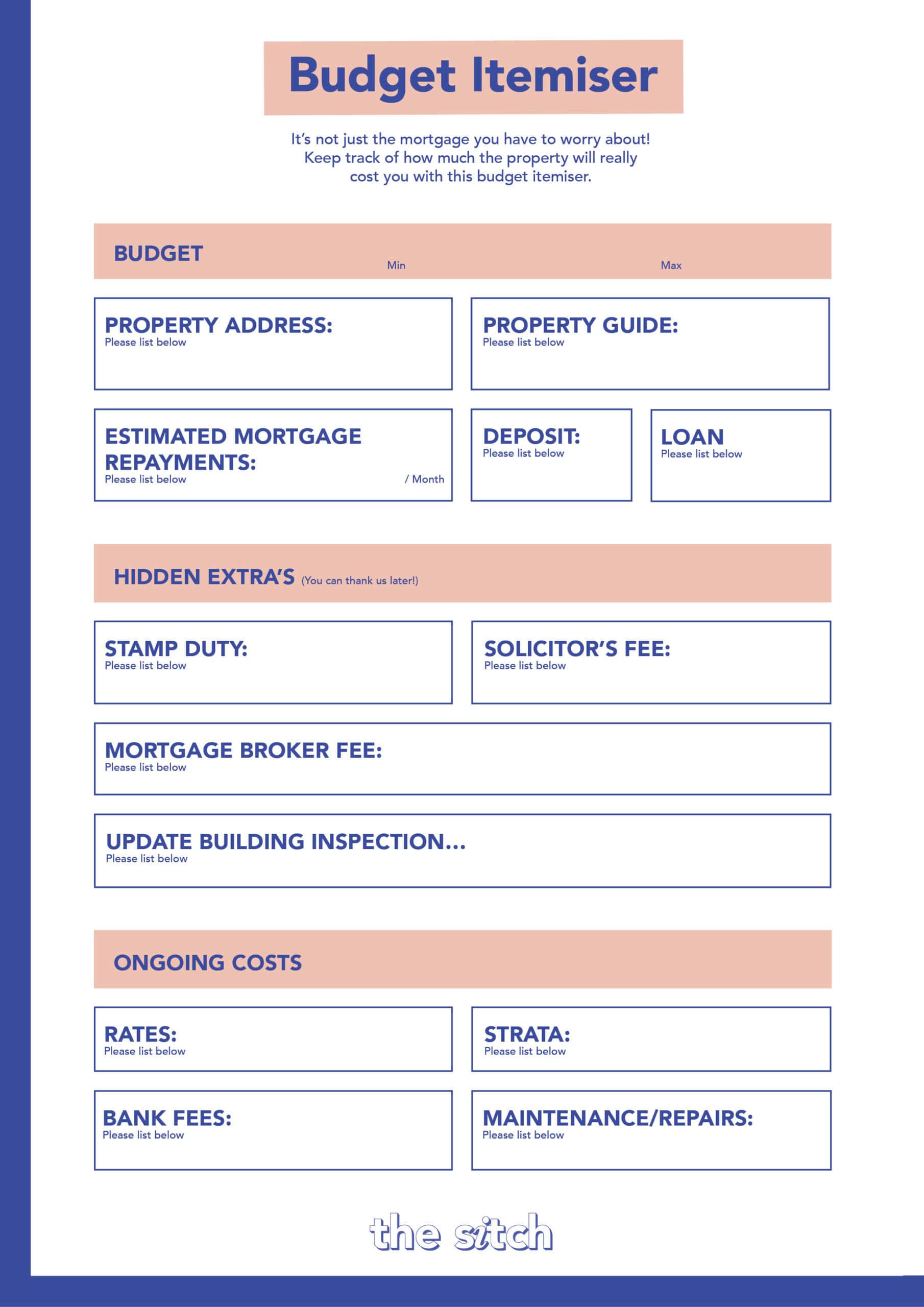

Calculate Your Repayments & Upfront Costs

Remember there is a big difference between how much you are eligible to borrow and what you can realistically afford. Once you have an estimate of your monthly mortgage repayments, create a budget to see how these will fit into your monthly average spending and lifestyle. Don’t forget to include stamp duty along with other government fees and charges.

There are a number of additional fees associated with buying property. These include establishment fees for your mortgage, legal fees, appraisal fee, pest and building inspections, insurance and moving costs. They may not be significant costs individually but can quickly add up, so be sure to factor them into your budget.

Understand How Much You Can Borrow

Buying property is a big decision and serious financial investment. The first step (and the most important) in your property journey is understanding how much you can afford to spend. First home buyers should aim to have a saved deposit of 10 per cent to 20 per cent of the purchase price, any less and you may have to pay Lenders Mortgage Insurance (LMI).

Speak to your bank or a mortgage broker to determine how much you can afford to borrow and apply for conditional approval. This will depend on a number of factors such as income, employment status, credit record and any assets or investments.

Know the Local Market

Once you have a clear picture of what you can afford, you can start looking for homes within your budget. This is the fun part, right? Start by shortlisting the neighbourhoods you would like to live in and making a list of “must haves” versus “nice to have”.

Researching the real estate market is key. Speak to local real estate agents and look at the weekly auction results to get a clear picture of what properties are selling for in the current market. Consider the overall market trends and the factors causing properties to sell for higher or lower than average.

Seek Legal Advice

Buying property comes with a lot of paperwork. Once you’ve found a home you are interested in purchasing, it’s important to get independent legal advice. Engage a conveyancer or solicitor to go through the contract and fine print, along with the strata report, to ensure the contract is sound. This will help you feel confidence come auction day.

If you are the successful buyer, your conveyancer or solicitor will manage the settlement process, including all the financial and administrative tasks involved in transferring a property to its new owner.

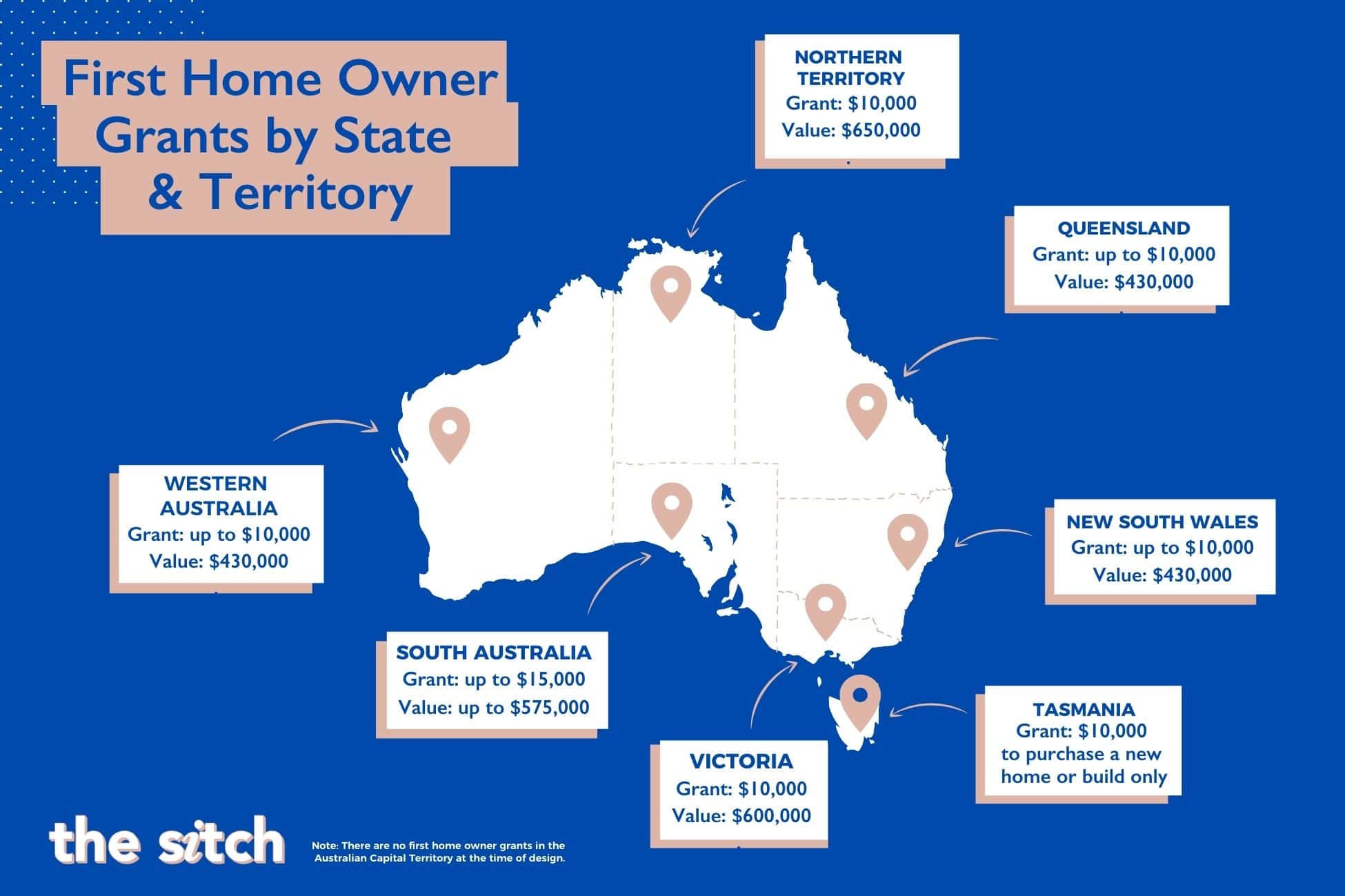

Are you Entitled to any Grants?

Australia’s First Home Owner Grant (FHOG) helps to ease the cost of buying real estate. Each state has its own set of rules and criteria, with some states offering up to $20,000. Stamp duty concessions and exemptions are also available in some states. Make sure you check your eligibility on the First Home Owner Grant website.

Prepare for the Sales process

Auctions are daunting. Don’t let your first auction experience be the property you are interested in purchasing. It’s worth attending a few auctions beforehand to gauge how the process works and what you are in for. The most important thing to remember is to set your budget and stick to it. Once the bidding starts it is very easy to get caught up in the game.

Private treaty sales are also common in Australia, where the vendor will negotiate with potential buyers via their agent. Private treaty sales give you more time to negotiate price and involve a cooling-off period, which doesn’t apply to auction sales.

Be sure to check out our Property page for all the property tips and tricks you might need when buying a property!

Subscribe

Subscribe

Subscribe

Subscribe