7 Things You Need to Know About Sydney’s Property Market

Buyers and sellers take note, here’s what you currently need to know about Sydney’s super-charged property market.

Substantial buyer activity coupled with limited stock and historically low interest rates has seen property prices surge across Sydney and regional NSW. Here are 7 key things buyers and investors need to know about the current market.

A Strong Demand for Property

Despite the pessimistic forecasts of mid-2020, Sydney house prices have continued to increase, with banks predicting house prices could jump by up to 19% by the end of the year. Auction clearance rates continue to remain high, between 70-80%, while mortgage registrations are at record-breaking levels. First home buyers and investors are looking to re-enter the market, with the security that they will see increases in their investment over time.

Sydney is a Seller’s Market

An increase in buyer sentiment and consistently high clearance rates suggest that there are now more buyers than there are sellers in the Sydney property market, marking the return of the ‘seller’s market.’ As reported by Domain, during March and April nearly 10% of homes for sale had price guides revised upwards mid-campaign, in an attempt to reflect buyer interest and ensure they were more realistic. More investors are entering the market, with many properties selling within days of hitting your search results. However, as sellers race to list their properties and an influx of new homes hit the market, property price growth should slow down.

Overall Property Prices will Continue to Rise

House prices are predicted to rise by 25% by the end of 2023, while the Reserve Bank of Australia are likely to hold off increasing interest rates for the next three years. The government has introduced many incentives to first-home buyers, yet they will see fierce competition from investors who traditionally have purchased similar properties. Historically low interest rates have meant investors are re-entering the market in droves.

Houses are Outpacing Units

According to Domain’s House Price Report, houses at the upper end have seen the strongest quarterly gains, with the most lucrative areas being the eastern suburbs, northern beaches, Baulkham Hills and Hawksbury. During lockdown and the continued working from home trend, the demand for houses peaked as people prioritised larger living spaces. That being said, units in Sydney’s coveted areas are quickly being snapped up as buyers are priced out of the housing market. According to Domain, on average, units in Chatswood, Lane Cove and Pittwater and selling nine days sooner than houses.

Premium Properties Reign Supreme

Sydney’s momentous price growth has been largely driven by the top end of the market. Areas in Sydney that have a strong track record of growth are the most likely to continue to perform well. The North Shore, Northern Beaches and Eastern Suburbs have seen price increases of up to 30 per cent in suburbs such as Northbridge, Drummoyne and Mosman, while overall beachside suburbs are outperforming the wider market. High-quality houses and apartments, particularly those that are well located with unique attributes, will retain their sought-after status and hold value.

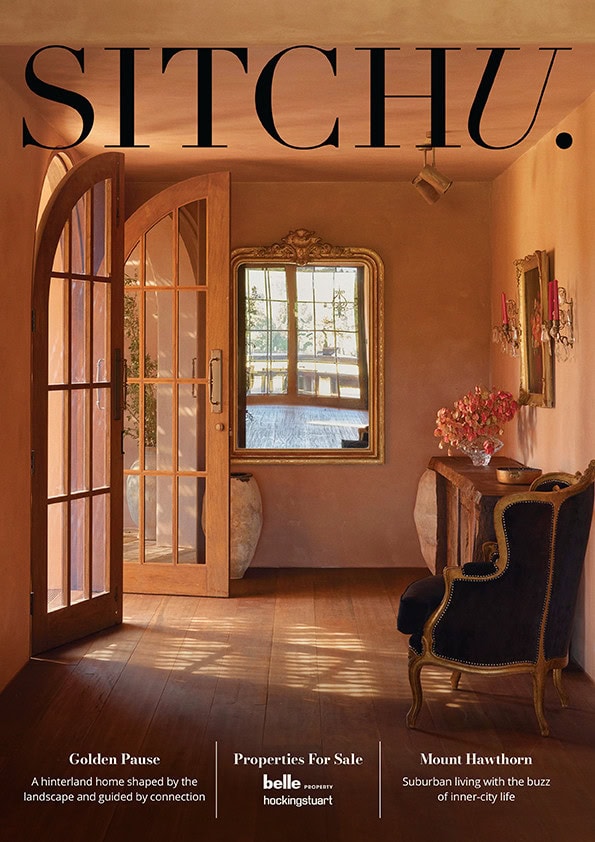

Greater Preference for Lifestyle Living

Covid-19 has certainly shown us that buyers will preference location above all else. Homemakers are willing to pay a premium to upgrade their lifestyle, seeking out neighbourhoods with excellent community and recreational facilities, close to shopping, sporting amenities and education. Coastal and tree change destinations have experienced rapid growth, fuelled by the working from home trend becoming a long-term solution. The movement, previously popular among retirees and empty nesters, is gaining popularity among young families seeking more space and a better quality of life.

The Smaller Living Movement

In popular areas such as the Eastern Suburbs and Northern Beaches, Sydneysiders are happier to live in apartments than has been the case in any other capital city. Millennials priced out of the market are eager to rent in desirable suburbs where they can maintain their coveted lifestyle, driving property values up. Investor owners should be wary of Sydney’s high supply locations, such as the inner-city CBD, where we’re seeing reduced demand and elevated vacancy rates largely due to closed international borders.

Subscribe

Subscribe

Subscribe

Subscribe